salt tax deduction explained

Capping the deduction in 2017. However many filers dont know.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

This means those that take the standard tax deduction and do not itemize their tax return are not really affected by the potential change.

. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. TCJA and the 10000 SALT Cap. The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes.

In 2016 77 percent of the benefit of the SALT deduction accrued to those with incomes above 100000. For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. The SALT deduction is one of the largest federal tax expenditures as it costs the federal government trillions of dollars in lost revenue opportunities.

The SALT state and local tax cap doesnt allow people to deduct more than 10000 of specific state and local taxes from their federal income USSA News. You can see why the federal government was looking to eliminate it at first. The SALT deduction has been a part of our federal income tax since 1913.

The deduction also incentivized states to tax their residents more progressively since the SALT deduction applies to types of taxes that tend to be progressive like taxes on income. However for individual taxpayers who itemize their deductions the Tax Cuts and Jobs Act TCJA introduced a 10000 limit on state and local taxes paid that an individual can deduct during the year 5000 for. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly. That limit applies to all the state and local.

The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform framework released by. According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Income taxes sales taxes personal property taxes and certain real property taxes are eligible for the SALT deduction 1.

In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. 150 allow passthrough entities including partnerships limited partnerships LLCs and S Corporations to get around the 10000 limitation on SALT by permitting them to pay tax on its income at a 93 rate which is then taken as a deduction on the entitys federal income taxes and treated as a.

Under current policy the SALT deduction cap is not adjusted for inflation. The federal tax reform law passed on Dec. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Section 164 of the Internal Revenue Code IRC generally allows a deduction for state and local taxes paid. Only 66 percent went to. Because of the limit however the taxpayers SALT deduction is only 10000.

The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly those in high-income and high-tax states. Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB. On Monday the Supreme Court refused to review a challenge brought against a tax deduction limit which was implemented by the Trump administration and has continued through the Biden administration.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. Biden S Tax Plan Explained For High Income Earners Making Over 400 000 Under TCJA the SALT deduction was capped at 10000 for single filers and married couples filing jointly. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont. According to a report from the Tax Policy Center taxpayers with incomes of over. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. 52 rows The state and local tax deduction commonly called the SALT deduction. The lowest rate is 10 for incomes of single individuals with incomes.

53 rows One such provision is the 10000 cap on the state and local tax SALT deduction. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize.

Ways the SALT deduction cap can be offset for high earners As incomes rise the loss in deductions can also be offset by the decrease of the top federal income tax rate from 396 to 37 the doubling of the estate tax deduction and the cutting of the capital gains rate from 238 to 21. What does the SALT deduction cap do. Deductible taxes include state and.

Theoretically state and local governments could then use revenues to invest more in public goods and services like roads and bridges than they would be able to without the federal subsidy.

State And Local Tax Salt Deduction Salt Deduction Taxedu

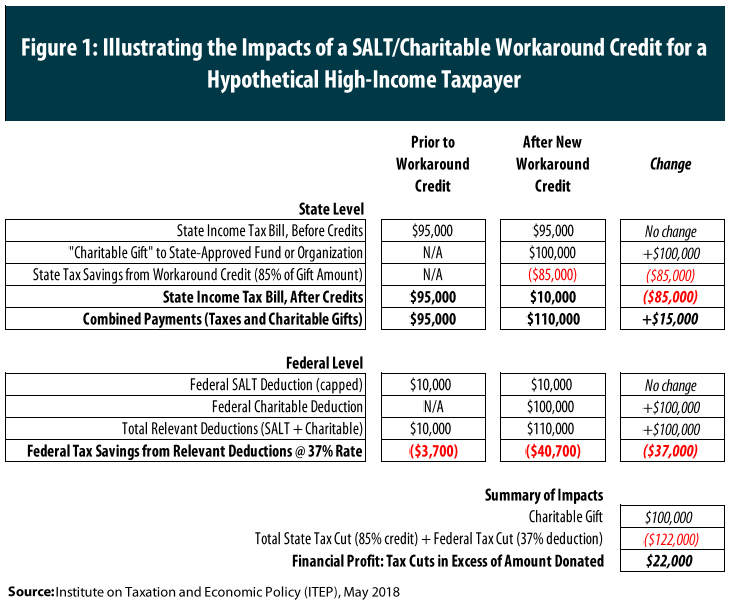

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Tax Deduction Will Democrats Cut Taxes For The Rich Steve Forbes What S Ahead Forbes Youtube

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep